Dreaming of a new home but feeling priced out? You’re not alone! A 2024 survey by Royal LePage found that 46% of Gen-Z and millennial Canadians who don’t already own a home have doubts as to whether they’ll ever be able to afford one.1

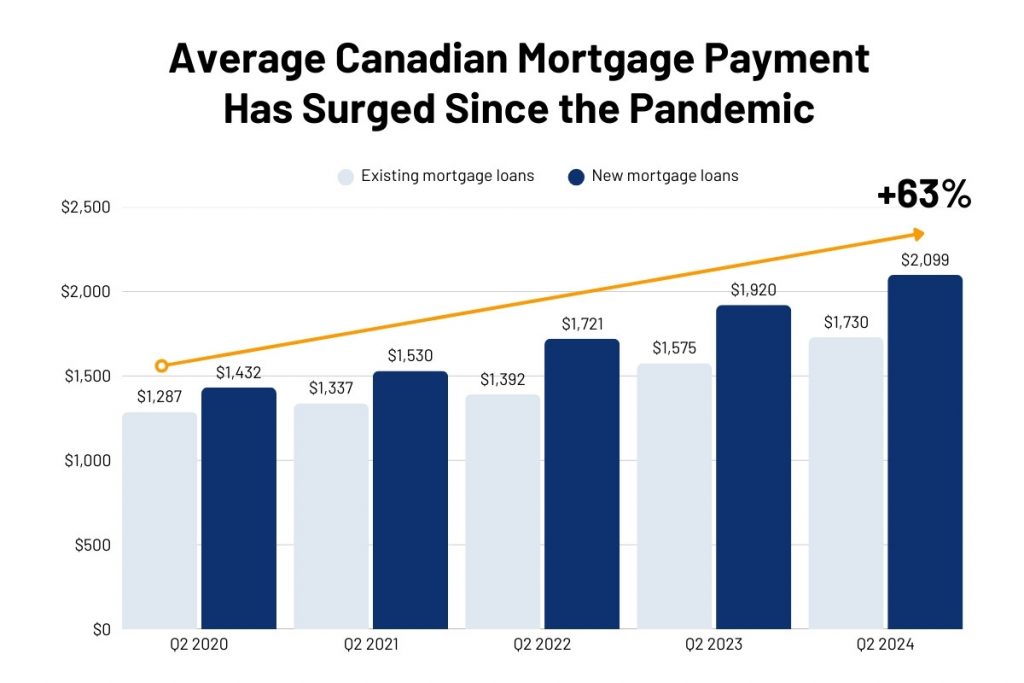

According to data from Canada Mortgage and Housing Corporation (CMHC) and Equifax, average monthly payments for new mortgage loans have risen 47% since the second quarter of 2020.2

Nevertheless, homeownership remains a significant value for Canadians, with 84% of 18 to 34-year-olds agreeing that buying a home is a worthwhile investment.1 And if you’re among that number, there are plenty of ways to make your homeownership dreams a reality.

In this guide, we’ll explore five common roadblocks to affordable homeownership and actionable solutions to help you overcome them. Let’s break down those barriers so you can finally get the home of your dreams!

ROADBLOCK #1: I Don’t Have Enough Saved For A Down Payment

Many prospective buyers believe they need a 20% down payment to buy a home. But in reality, there are ways to purchase a home in Canada with as little as 5% down.3 For buyers who qualify, there are a number of programs that can help make a home purchase more accessible

Government-Backed Mortgage Insurance

CMHC mortgage insurance is a great option for buyers who are short on cash. This insurance allows for down payments as low as 5% for homes that cost $500,000 or less. If the home costs between $500,000 and $1.5 million, you’ll need a minimum of 5% down on the first $500,000 and 10% on the remainder.3 This can make homeownership more affordable for those who haven’t saved up enough for a large down payment.

Utilize a Tax-Free First Home Savings Account (FHSA)

If you open an FHSA, you can reduce your taxable income while you save for a down payment. This type of account, which is only available to first-time homebuyers, allows you to save up to $8,000 tax-free the first year, with contribution limits in subsequent years depending on your individual situation. You can save up to $40,000 in an FHSA in total.4

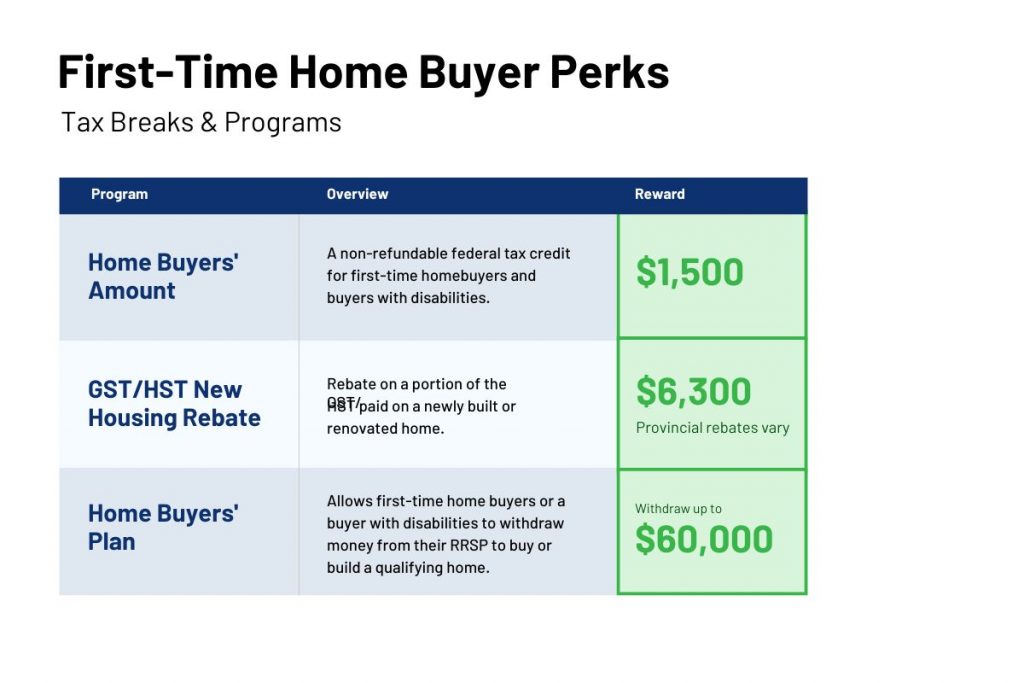

Maximize the Home Buyers’ Plan (HBP)

The HBP is a government program that allows first-time homebuyers to withdraw up to $60,000 from their registered retirement savings plans (RRSPs) to buy or build a qualifying home.5 This can be a significant boost to your down payment savings. Be sure you understand the repayment rules and deadlines to avoid any tax penalties.

Explore Provincial Programs

In addition to the HBP, some areas offer programs to assist with down payments, ranging from cash assistance to interest-free loans.6 We can help you research the programs available to see if you qualify.

Family Gifts

Parental support has become increasingly common in Canada. A recent study found that 31% of first-time buyers receive financial help from a family member.7 If you’re fortunate to have family support, be sure to follow the proper procedures to document the gift and ensure it complies with Canada Revenue Agency guidelines.

Existing Home Equity

If you already own a home, you may have more equity than you realize. This equity (or difference between your home’s current value and what you owe on your mortgage) could go toward a down payment on a new property. Wondering how much equity you have in your current home? Reach out for a free home value assessment.

ROADBLOCK #2: I Can’t Afford the Monthly Payment

Worried about those monthly mortgage payments? High interest rates and rising costs can make mortgage payments feel daunting. But there are strategies to reduce your monthly burden.

Choose an Extended Amortization Period

The traditional 25-year amortization period for a mortgage isn’t your only option. First-time homebuyers and buyers of new builds qualify for 30-year mortgage amortization, which can help lower your monthly payments, though it also means you’ll be paying off your home longer and will pay more in interest.8

Co-Buy with Family or Friends

A growing number of homebuyers are returning to multigenerational living or are even buying a home with friends.9 This arrangement enables you to cut costs significantly while sharing both the time and financial responsibilities of homeownership. We can help you search for homes that are well suited for your group.

Purchase a Home with Income Potential

You can generate extra income to offset your mortgage payments by purchasing a duplex, renting out a room or an accessory dwelling unit (like a garage apartment), or even listing your property on Airbnb. We work with investors and can help you find a property to meet your goals.

ROADBLOCK #3: I Can’t Qualify for a Mortgage

Qualifying for a mortgage can be a stressful process, especially if you have previously faced financial challenges. But you might be pleasantly surprised—there’s a lot you can do to improve your chances of success.

Boost Your Credit Score

Your credit score is foundational when it comes to getting a mortgage. A higher score typically means a lower interest rate and more options. Take steps to improve your credit by paying bills on time, reducing debt, and checking your credit report for errors.10 Even a small improvement in your score can make a big difference. Pro tip: Avoid opening or closing credit cards or taking out other loans (like car or personal loans) if you plan to start home shopping in the near future.

Lower Your Debt Service Ratios

Lenders want to be sure that you can afford your monthly mortgage payment alongside any other debts. That’s why they calculate both your gross debt service ratio, or GDS (the percentage of your income that will go towards the cost of a particular property), as well as your total debt service ratio, or TDS (the percentage of your income that goes to all loan payments, including mortgage, car loans, credit cards, etc.)11 Paying down other types of debt, like your car loan, will leave more space in your budget for a monthly mortgage payment.

Consider Getting a Co-Signer

Having a co-signer with a stronger credit history or more income can strengthen your application, but make sure you (and they) understand the risks and responsibilities involved.12

ROADBLOCK #4: I Can’t Find a Home in My Price Range

Feeling frustrated by the lack of affordable homes on the market? Unfortunately, this is a common problem. But with a little flexibility and guidance, it’s possible to find a great property to fit most budgets.

Expand Your Home Search

You may need to search outside your target area. In many markets, home prices vary drastically within the span of miles. Being open to exploring alternative neighbourhoods or those farther from the city centre can open up surprising possibilities. As local market experts, we can help you discover hidden gems and up-and-coming neighbourhoods. Reach out for a complimentary consultation.

Revisit Your Must-Haves

Take a close look at your “must-have” list. Are there any features you can compromise on to expand your options and find a more affordable property? For example, do you really need two bathrooms, or could you settle for a single bathroom with space to add a second one in the future? These types of compromises can sometimes shave tens of thousands off your purchase price. We’re happy to offer our thoughts on the features that you’re likely to find within your budget.

Consider Fixer-Uppers

Looking to cut purchase costs? Don’t shy away from homes that need a little TLC. Fixer-uppers usually come with a lower price tag, and you can personalize the renovations to your taste.13 Just be sure to factor in the cost of repairs and renovations when determining your budget—and to be realistic about your own home repair skills! If you’re interested in exploring fixer-upper opportunities, we can help you identify properties with potential and connect you with reliable contractors.

ROADBLOCK #5: I’m Overwhelmed by the Process

Buying a home can feel like navigating a maze. Between searching for properties, securing financing, negotiating contracts, and handling paperwork, the process can quickly become overwhelming. But you don’t have to do it alone! We can simplify every step, helping you stay organized, informed, and confident in your decisions.

Find the Right Home Faster

The sheer number of listings on the market can be daunting, and homes that meet your criteria may not always be easy to find. Our team can:

- Save you time by narrowing down homes that fit your budget, needs, and lifestyle.

- Get you access to off-market and pre-listing properties that aren’t widely advertised.

- Provide insights on local market trends to help you make a competitive offer.

Navigate Financing & Paperwork With Ease

Real estate transactions involve complex contracts, legal documents, and lender requirements. One misstep could delay your purchase—or even cost you your dream home. We will:

- Help you find down payment assistance that you may not be aware of.

- Explain mortgage options and connect you with reputable lenders.

- Ensure all purchase documents are accurate and deadlines are met.

Score the Best Deal

Many buyers worry about overpaying for a home or getting stuck with costly repairs, but we know how to:

- Use expert negotiation tactics to secure the best possible price.

- Identify hidden costs so you aren’t caught off guard at closing.

- Negotiate repairs or seller concessions to save you money.

Streamline Inspections & Closing

The home inspection and closing process can bring last-minute surprises. We avoid these by:

- Helping you interpret inspection reports and advising on necessary repairs.

- Coordinating with your lender and other parties to keep everything on track.

- Preparing you for closing day so you know exactly what to expect.

Benefit From Ongoing Support

Our relationship doesn’t end once you get the keys. We always go the extra mile to:

- Recommend trusted contractors for renovations and repairs.

- Help you make strategic upgrades through complimentary real estate consultations.

- Provide market updates in case you want to refinance or sell later.

The bottom line? You don’t have to navigate this process alone. When you work with us, you’ll have a trusted partner to handle the complexities, answer your questions, and ensure everything goes smoothly from start to finish.

LET’S TURN ROADBLOCKS INTO STEPPING STONES TOWARD YOUR DREAM HOME

Buying a home may come with challenges, but none of them are impossible to overcome. With the right strategies, resources, and expert guidance, you can navigate these obstacles with ease.

Whether you’re worried about saving for a down payment, qualifying for a mortgage, or finding the right home in your price range, there are solutions available to help you move forward. The key is to stay informed, explore all your options, and work with professionals who can guide you every step of the way.

Our team is here to help you find the right home, secure the best financing, and negotiate the best deal—without the stress and uncertainty of doing it all yourself. Let’s turn your homeownership dreams into reality. Contact us today to get started!

The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs.

SOURCES:

- Royal LePage –

https://blog.royallepage.ca/gen-zs-and-young-millennials-still-believe-in-home-ownership-and-theyre-willing-to-make-sacrifices-to-achieve-it/ - CMHC –

https://www.cmhc-schl.gc.ca/professionals/housing-markets-data-and-research/housing-data/data-tables/mortgage-and-debt/mortgage-consumer-credit-trends-cmas - Canada Mortgage Housing Corporation –

https://www.cmhc-schl.gc.ca/consumers/home-buying/mortgage-loan-insurance-for-consumers/what-is-mortgage-loan-insurance - Government of Canada –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/first-home-savings-account.html - Government of Canada –

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/what-home-buyers-plan.html - Loas Canada –

https://loanscanada.ca/mortgage/down-payment-assistance-programs-in-canada/ - Fidelity –

https://www.fidelity.ca/en/insights/articles/guide-to-home-down-payment/ - Government of Canada –

https://www.canada.ca/en/financial-consumer-agency/services/mortgages/mortgage-terms-amortization.html - CBC –

https://www.cbc.ca/news/canada/british-columbia/canada-bc-multi-generational-housing-affordable-1.7134448 - Equifax –

https://www.equifax.ca/personal/education/credit-score/articles/-/learn/how-to-improve-your-credit-scores/ - Ratehub –

https://www.ratehub.ca/debt-service-ratios - Rocket Mortgage –

https://rocketmortgage.ca/learning-centre/mortgage-basics/cosign-mortgage/ - Zoocasa –

https://www.zoocasa.com/blog/is-a-fixer-upper-right-for-you/

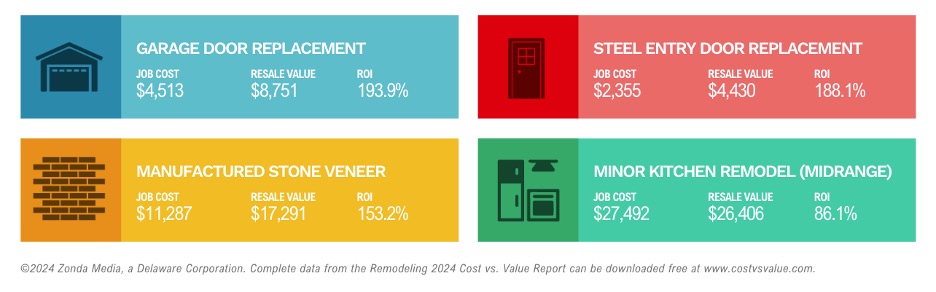

Before diving into specific projects, it’s important to understand how the data supporting these ROI estimates was gathered. This article references findings from the 2024 Cost vs. Value Report conducted by Zonda Media, a reputable research firm in the real estate and construction industries. The report’s ROI figures are based on national averages for both the cost of materials and labour, which means that regional differences may lead to variations in actual returns.

Before diving into specific projects, it’s important to understand how the data supporting these ROI estimates was gathered. This article references findings from the 2024 Cost vs. Value Report conducted by Zonda Media, a reputable research firm in the real estate and construction industries. The report’s ROI figures are based on national averages for both the cost of materials and labour, which means that regional differences may lead to variations in actual returns.