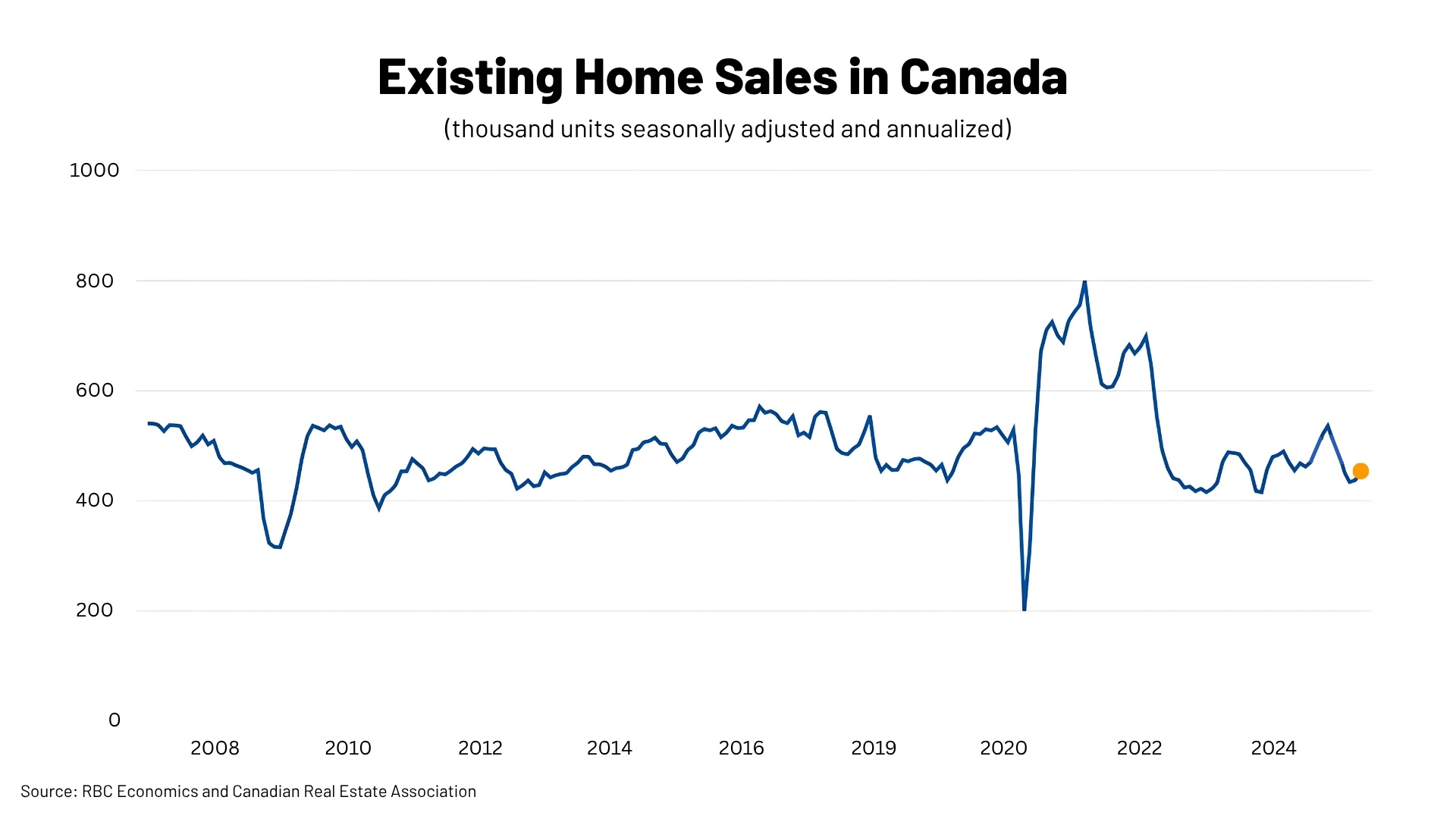

Will 2026 be the year Canadian buyers stop waiting? Most major housing forecasters believe activity will finally pick up after two muted years, but expectations vary on how strong that rebound will be and where it will show up first. After a sluggish and uncertain 2025, the Canadian housing market appears positioned for gradual normalization rather than a sharp recovery.

The Canadian Real Estate Association (CREA) now forecasts national home sales of roughly 509,000 transactions in 2026, representing about 7–8% growth year over year.¹,² That would place activity above 2025 levels, though still below long-term historical averages. Average prices are expected to return close to the $700,000 range, reflecting modest appreciation rather than a renewed surge.1,3

Nearly every major Canadian forecaster agrees on the direction of sales activity—more transactions in 2026 than in 2025—but opinions diverge on prices and the pace of recovery.1,4,7,9 Where opinions diverge is on the pace. Some expect buyers to re-enter steadily as rates stabilize. Others believe affordability constraints will continue to cap transaction volumes, particularly in higher-priced regions. As in the U.S., the key question is behavioral: when do buyers and sellers finally accept that current conditions represent the new normal?

The 2025 Context: A Delayed Recovery, Not a Breakdown

In early 2024, CREA projected that 2025 would mark a meaningful rebound year for Canada’s resale market, driven by pent-up demand and easing interest rates.¹ By late 2024, that recovery appeared to be forming. Under that forecast, national home sales were expected to exceed 500,000 transactions, with average prices climbing back toward $700,000.

That momentum stalled in early 2025. Trade uncertainty, broader economic unease, and affordability pressures pushed many buyers back to the sidelines, prompting CREA to downgrade its outlook.4 Sales activity softened most noticeably in British Columbia and Ontario, while prices in several major urban markets came under renewed pressure.4,10

Importantly, the market did not deteriorate further. Beginning in spring 2025, CREA data showed a showed continued improvement in sales activity, suggesting that demand was delayed rather than destroyed.⁵ The result is a downward revision to 2025 forecasts, but solid upward momentum heading into 2026, with last year’s 2025 expectations now effectively pushed out one year.1,4

2026 Forecasts: Where Canadian Forecasters Agree and Disagree

Sales Activity: Gradual Thaw, Not a Flood

Sales forecasts for 2026 cluster more tightly in Canada than in the U.S., but uncertainty remains. CREA’s national forecast implies high-single-digit growth, bringing sales back into the low-500,000 range.1,2 RE/MAX Canada similarly expects increased activity, citing improving consumer confidence and buyers adjusting to current financing realities.9

The central uncertainty is not economic capacity but psychology. Many Canadian buyers spent the past two years waiting for more aggressive rate cuts or price declines. As those expectations fade, the decision to re-enter the market increasingly hinges on life events—job changes, family needs, downsizing, or relocation—rather than market timing.3,7

Unlike the pandemic rebound, 2026 is unlikely to bring a surge of speculative or urgency-driven buying. Instead, forecasters expect incremental increases in transaction volume, market by market, price tier by price tier.9,14

Home Prices: A Tug-of-War Between Growth and Correction

Price forecasts for 2026 reveal a rare divergence among Canada’s top housing analysts, signaling a market in transition. While the consensus points to stability, experts disagree on whether the national average will tick up or drift slightly lower.

CREA projects the national average home price to rise roughly 3.2% in 2026, returning close to the $700,000 mark.1,2 This aligns with Royal LePage’s outlook, which forecasts aggregate price growth of approximately 1%, supported by steady demand in more affordable provinces.7

However, not all outlooks are positive. RE/MAX Canada stands as a notable outlier, forecasting a national average price decline of roughly 3.7%, despite rising sales activity.9 This bearish view highlights the heavy weight of inventory buildup in Canada’s most expensive markets.

The “Two-Speed” Market Continues Regardless of the national average, all forecasters agree on a widening regional gap:

- The Correction Markets: Higher-priced regions like Greater Toronto and Greater Vancouver are expected to see flat to negative price movement. Here, affordability ceilings have been hit, and listing inventory is rising faster than sales.7,8

- The Growth Markets: In contrast, affordable regions—specifically Alberta, Quebec, and Atlantic Canada—are forecast to outperform. These markets continue to attract inter-provincial migration and offer entry points that first-time buyers can actually afford.7,8

The data suggests that “national” price trends are becoming less relevant than local dynamics. Supply remains structurally constrained long-term, but in 2026, pricing power is increasingly localized.10,11

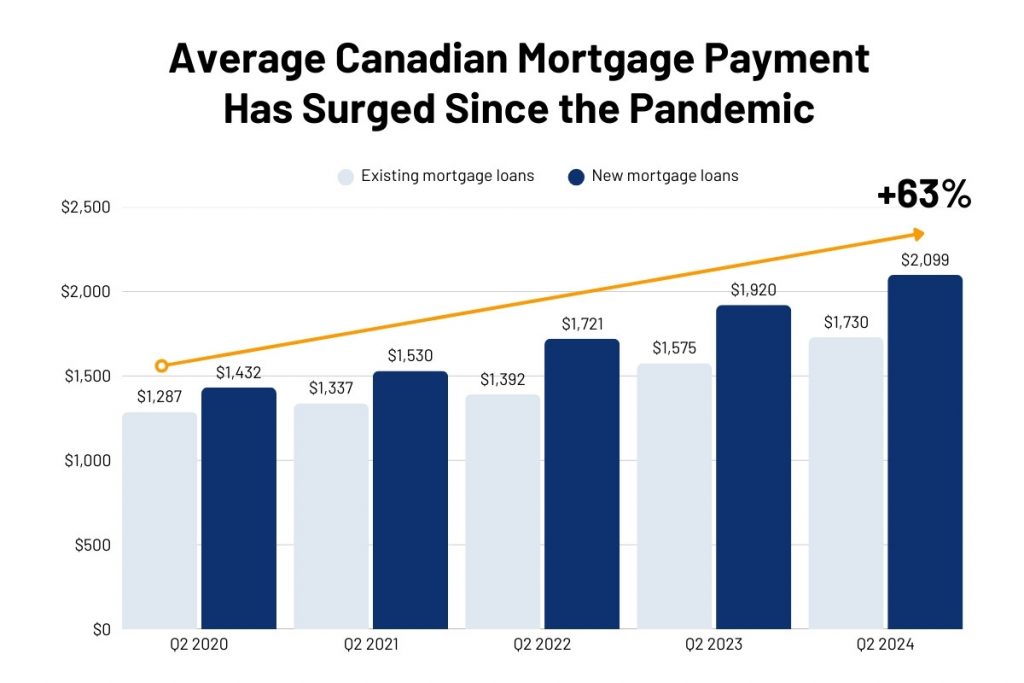

Interest Rates and Affordability: Stability Over Relief

Unlike the U.S., Canadian mortgage expectations hinge on Bank of Canada policy rather than long-term bond-market forecasts. Current consensus suggests the policy rate is nearing a plateau, with rate cuts largely behind us and borrowing costs expected to remain relatively stable into 2026.12,13

For buyers and sellers, this means rate stability matters more than rate relief. While borrowing costs may ease modestly, affordability improvements are expected to come gradually through income growth and slower price appreciation rather than dramatic financing changes.3,13

The practical implication mirrors the U.S. experience: waiting for a return to 2020–2021 conditions is increasingly unrealistic. The market is adjusting to a higher-rate baseline, and participants must plan accordingly.3,7

What This Means for Buyers

For buyers, 2026 offers improved conditions compared with the past two years—but not a buyer’s market across the board. Inventory has increased modestly, competition has cooled, and bidding wars are less common outside of the most desirable properties and locations.2,4

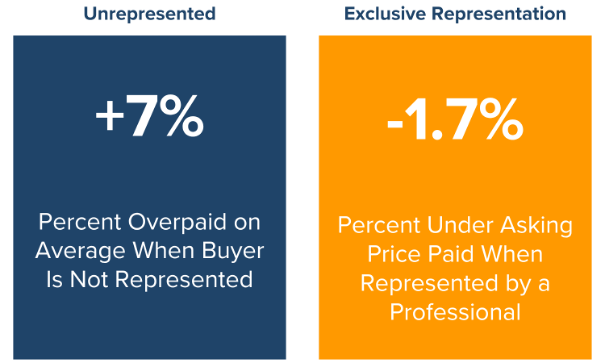

At the same time, prices are not expected to fall meaningfully at the national level. Waiting may result in slightly better selection or marginally lower borrowing costs, but not dramatically cheaper homes.1,3,7 As a result, the advantage in 2026 lies with prepared buyers: those with financing in place, realistic expectations, and flexibility on timing or location.

First-time buyers continue to face the steepest challenges. High upfront costs and qualifying constraints remain barriers, particularly in major metros.14 However, slower price growth and calmer competition give first-time buyers more room to negotiate and plan than during the pandemic surge.9

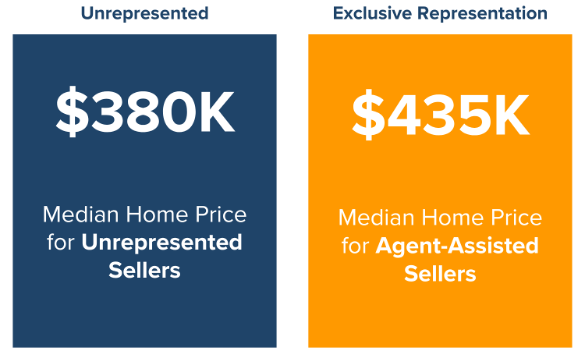

What This Means for Sellers

For sellers, 2026 is likely to feel more balanced—and more demanding—than recent years. The automatic leverage sellers enjoyed during the pandemic has faded. Outcomes will depend heavily on pricing accuracy, property condition, and local supply-demand dynamics.7,10

Overpricing carries greater risk in a market where buyers are patient and well informed. Homes that are priced correctly and well prepared should still sell efficiently, while those anchored to peak-era expectations may linger.7,10 Concessions and strategic preparation are once again meaningful differentiators rather than optional extras.10

The lock-in effect remains a consideration for homeowners with very low mortgage rates, but life events and accumulated equity increasingly outweigh rate comparisons.11,14 As in the U.S., sellers are slowly recalibrating to the reality that today’s rates are durable, not temporary.

Renters and the Rent-vs-Buy Decision

For renters, 2026 remains a pragmatic decision year rather than a forced transition point. Renting often continues to offer lower short-term costs and flexibility, particularly in high-priced markets.14,15 At the same time, modest price appreciation suggests that waiting indefinitely may not yield better entry points.1,3

For those planning to buy in the future, 2026 is best viewed as a preparation window—strengthening credit, building savings, and identifying target markets—rather than a year of dramatic opportunity or risk.15

Conclusion: A Market Returning to Rhythm

The 2026 Canadian housing market is defined less by recovery than by normalization. Sales activity is expected to rise modestly. Prices should increase slowly, with wide regional variation. Interest rates are stabilizing rather than collapsing. The extremes of the pandemic era are firmly behind us.

Success in 2026 will not come from timing the market perfectly, but from adapting to it. Buyers gain more choice and negotiating room but face ongoing affordability challenges. Sellers retain advantages in undersupplied markets but must price and prepare carefully. Renters balance flexibility against long-term ownership goals.

As the market settles into a more sustainable rhythm, realistic expectations and local expertise matter far more than bold predictions.

Sources:

- Canadian Real Estate Association (CREA).

CREA Updates Resale Housing Market Forecasts for 2025 and 2026.

https://www.crea.ca/media-hub/news/crea-downgrades-resale-housing-market-forecast-amid-tariff-uncertainty-and-economic-uncertainty/ - CREA.

Quarterly Canadian Housing Market Forecasts.

https://www.crea.ca/housing-market-stats/canadian-housing-market-stats/quarterly-forecasts/ - Yahoo Finance Canada.

Home prices expected to tick higher in 2026 as sales rebound.

https://ca.finance.yahoo.com/news/home-prices-expected-tick-higher-090007704.html - Mortgage Professional Canada (MPA).

CREA trims 2025 home sales forecast as buyers delay return.

https://www.mpamag.com/ca/mortgage-industry/market-updates/crea-trims-2025-home-sales-forecast-as-buyers-delay-return/553264 - CREA.

Canadian home sales edge up again following third interest rate cut.

https://www.crea.ca/media-hub/news/canadian-home-sales-edge-up-again-following-third-interest-rate-cut/ - CBC News.

Canadian home sales rise as buyers slowly return.

https://www.cbc.ca/news/business/crea-home-sales-october-9.6981575 - Royal LePage.

Canada’s housing market poised for a reset in 2026.

https://www.royallepage.ca/en/realestate/news/canadas-housing-market-poised-for-a-reset-in-2026-with-modest-price-growth-and-increased-activity/ - Royal LePage Blog.

A reset is in store for Canada’s housing market in 2026.

https://blog.royallepage.ca/a-reset-is-in-store-for-canadas-housing-market-in-2026/ - RE/MAX Canada.

Canadian Housing Market Outlook.

https://blog.remax.ca/canadian-housing-market-outlook/ - Real Estate Magazine.

CREA downgrades housing market forecast.

https://realestatemagazine.ca/crea-downgrades-housing-market-forecast/ - Real Estate Magazine.

Five years of market swings set the stage for 2026.

https://realestatemagazine.ca/opinion-5-years-of-market-swings-set-the-stage-for-2026/ - Reuters.

Bank of Canada seen holding rates as housing stabilizes.

https://www.reuters.com/world/americas/bank-canada-done-cutting-rates-least-until-2027-house-prices-rebound-soon-2025-12-05/ - Bank of Canada.

Monetary Policy Reports & Rate Announcements.

https://www.bankofcanada.ca/core-functions/monetary-policy/ - Mortgage Professional Canada (MPA).

Buyers could edge back to Canada’s housing market in 2026, says Royal LePage.

https://www.mpamag.com/ca/mortgage-industry/industry-trends/buyers-could-edge-back-to-canadas-housing-market-in-2026-says-real-estate-giant/559474 - 15. Real Estate Magazine.

Real estate trends for 2026: Why Canada’s future may be brighter than it looks.

https://realestatemagazine.ca/real-estate-trends-for-2026-why-canadas-future-may-be-brighter-than-it-looks/